Case Study - Canada Top Student

Out of hundreds of applicants, I was selected amoung 32 students for a case competition event hosted by Scotiabank.

- Industry

- Technology

- Year

- Service

- Case Competition

Challenge

Design and develop an AI-driven platform to make Scotiabank’s services more accessible and user-friendly while addressing user concerns about security and trust. Focus on how AI can improve the banking experience while ensuring compliance with all protective measures.

-

Integrate AI to provide personalized financial advice and automated customer support.

-

Educate users on how AI improves security and simplifies banking through interactive tutorials and live support.

-

Allow users to securely perform transactions through the AI assistant while maintaining strict security protocols.

-

Use AI to monitor suspicious activities and alert users in real-time to prevent fraud.

-

Ensure AI services comply with regulatory and privacy standards to protect sensitive user data.

-Authenticate users through multi-factor authentication, including email, phone SMS, and biometrics (face/fingerprint recognition).

Solution

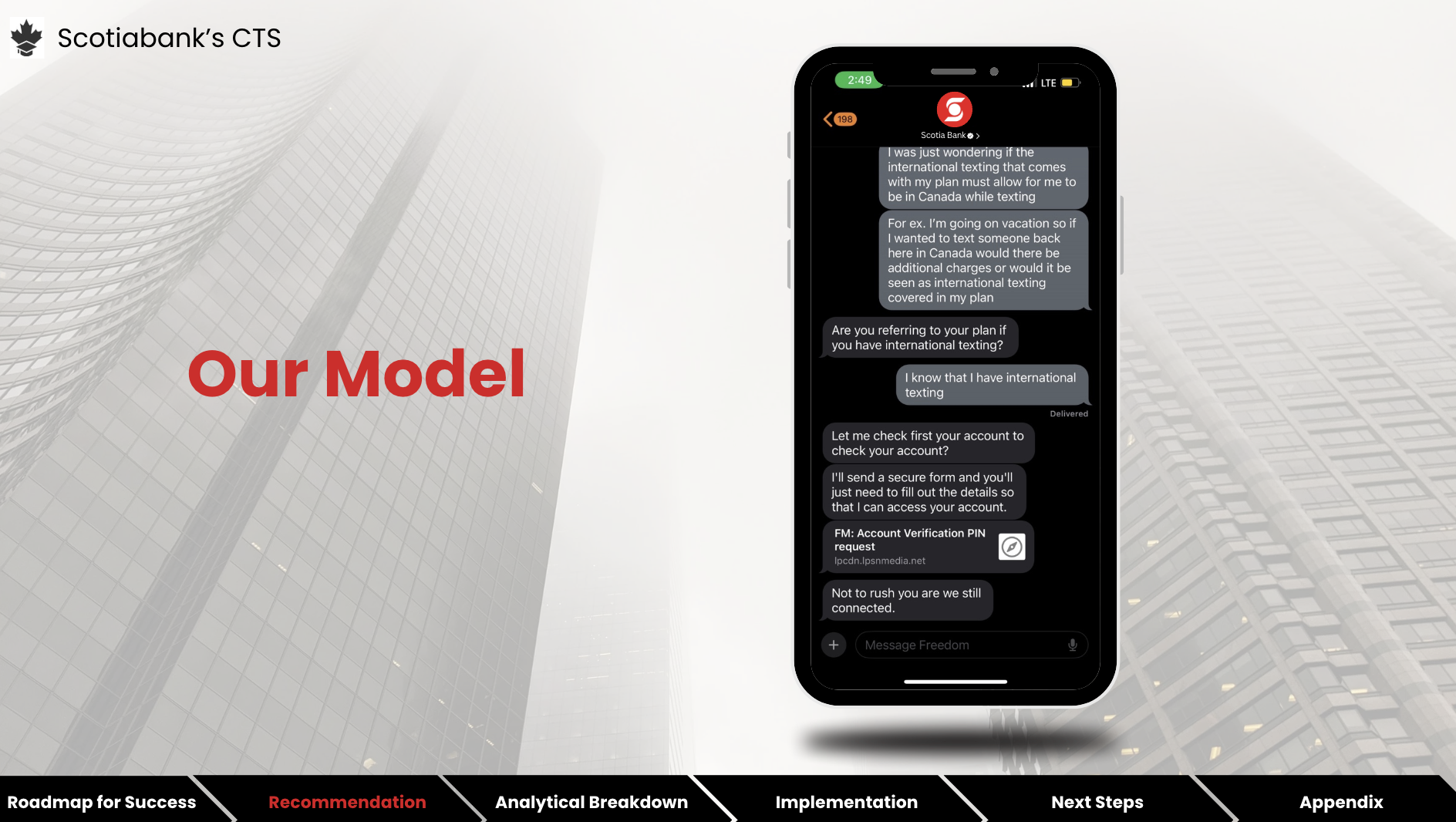

Image of application.

AI that detects fraud by analysing the user’s spending patterns and flagging irregular activities.

When suspicious activity is recognized, the user will receive an encrypted message to their phone number through Scotia Bank’s secure sending system to authenitcate their identity through a face ID or finger print scanning.

If the user wants to report fraud, they can directly text the message ScotiaBank’s AI chatbot who will provide instructions to direct the user thrgouh the process of reporting the fraud.

Scotiabank values handling customer data with appropriate security controls to ensure we’re adhering to bank policies and to minimize the risk of breach.

*Initial load is around ~2 minutes due to free hosting.

Technologies